Designing clarity in high-trust financial decisions

Reducing decision fatigue in a banking product catalog

Retail banking product pages are high-stakes decision environments. Users need to understand complex offers, compare options, and feel confident before taking action — often within just a few minutes and usually on mobile.

This case explores how to redesign the “Accounts & Cards” section of a retail banking platform to reduce cognitive load, improve comparability, and guide users toward a clear next step, without sacrificing transparency or trust.

Challenge

The existing experience required users to:

Read and remember information in order to compare products

Navigate between multiple views to understand differences

Interpret unclear CTAs and next steps

Search for critical conditions (fees, requirements, eligibility)

This resulted in decision fatigue, increased uncertainty, and delayed or abandoned actions.

The challenge was not visual polish, but helping users make a confident decision faster in a regulated, high-risk context.

My role

Role: Strategic UX Research & Experience Design

Scope: Discovery, problem framing, UX strategy, information architecture, interaction design

Context: Retail banking · Regulated environment

I led the process end-to-end, from research synthesis and strategic framing to design decisions and validation planning.

Research & problem framing

Key user need:

Users want to answer three questions quickly:

Which option is right for me?

How is it different from the others?

What do I need to do next?

Insights

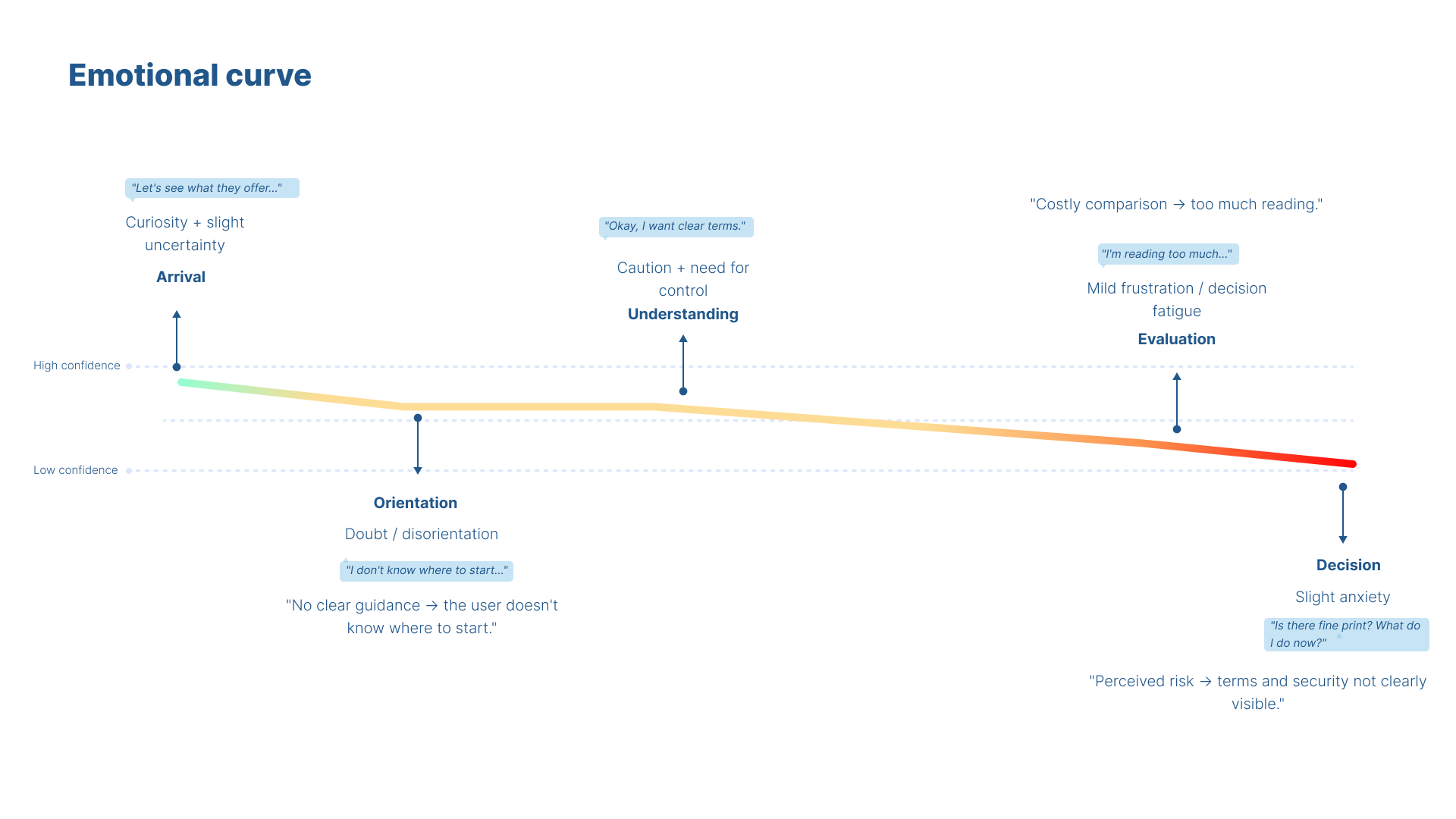

Research synthesis (persona, journey mapping, emotional curve analysis) highlighted three critical moments of friction:

Orientation: Users feel unsure about where to start and what to look at first

Comparison: Too much reading and inconsistent structures increase mental effort

Decision: Missing or hidden conditions increase perceived risk right before conversion

In banking contexts, clarity and confidence outweigh marketing language.

Strategic insights

From the research, several principles emerged:

Users scan first — structure matters more than copy

Comparison should rely on recognition, not memory

Reducing perceived risk is essential before asking for action

Too many CTAs dilute confidence instead of increasing choice

These insights directly informed the experience strategy.

Design principles

Recognition over recall

Users should compare options at a glance without memorizing details.One clear decision path

A dominant primary journey reduces hesitation and cognitive load.Progressive disclosure

Show what’s essential first, reveal detail only when needed.Confidence before conversion

Conditions, requirements, and reassurance must appear before the action.

Methods applied

-

Explorative Studies

Uncover user needs and behaviors. Interviewing customers who returned items to understand their expectations, frustrations, and decision-making process during purchase.

-

Quantitative Methods

Validate insights with data. Return Rate Analysis. Analyzing return data segmented by product type, size, and user profile to identify patterns and validate hypotheses about sizing or quality issues.

-

Journey Mapping

Visualize pain points and opportunities. Customer Journey Map Mapping the end-to-end experience from browsing to post-purchase to identify pain points like unclear sizing guides or misleading product photos.

-

Workshops

Co-creation Workshop with Users and Designers. Bringing together frequent returners and the design team to ideate improvements in product presentation, sizing tools, and post-purchase communication.

Solution overview

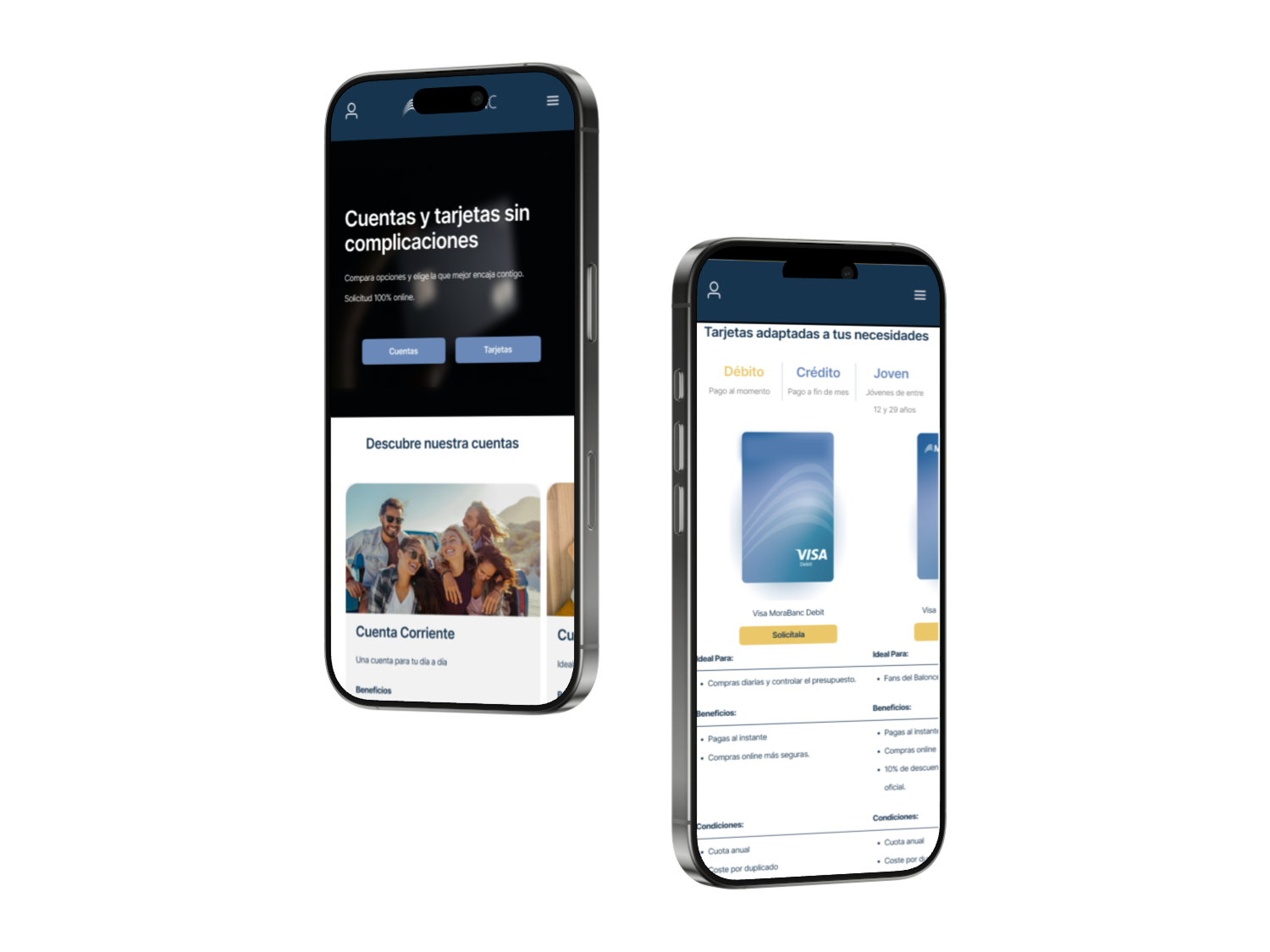

Clear structure & orientation

Immediate explanation of how to choose: “Choose your account, then the card that fits how you pay”

Quick access to main categories (Accounts / Cards)

Clear hierarchy from the first scroll

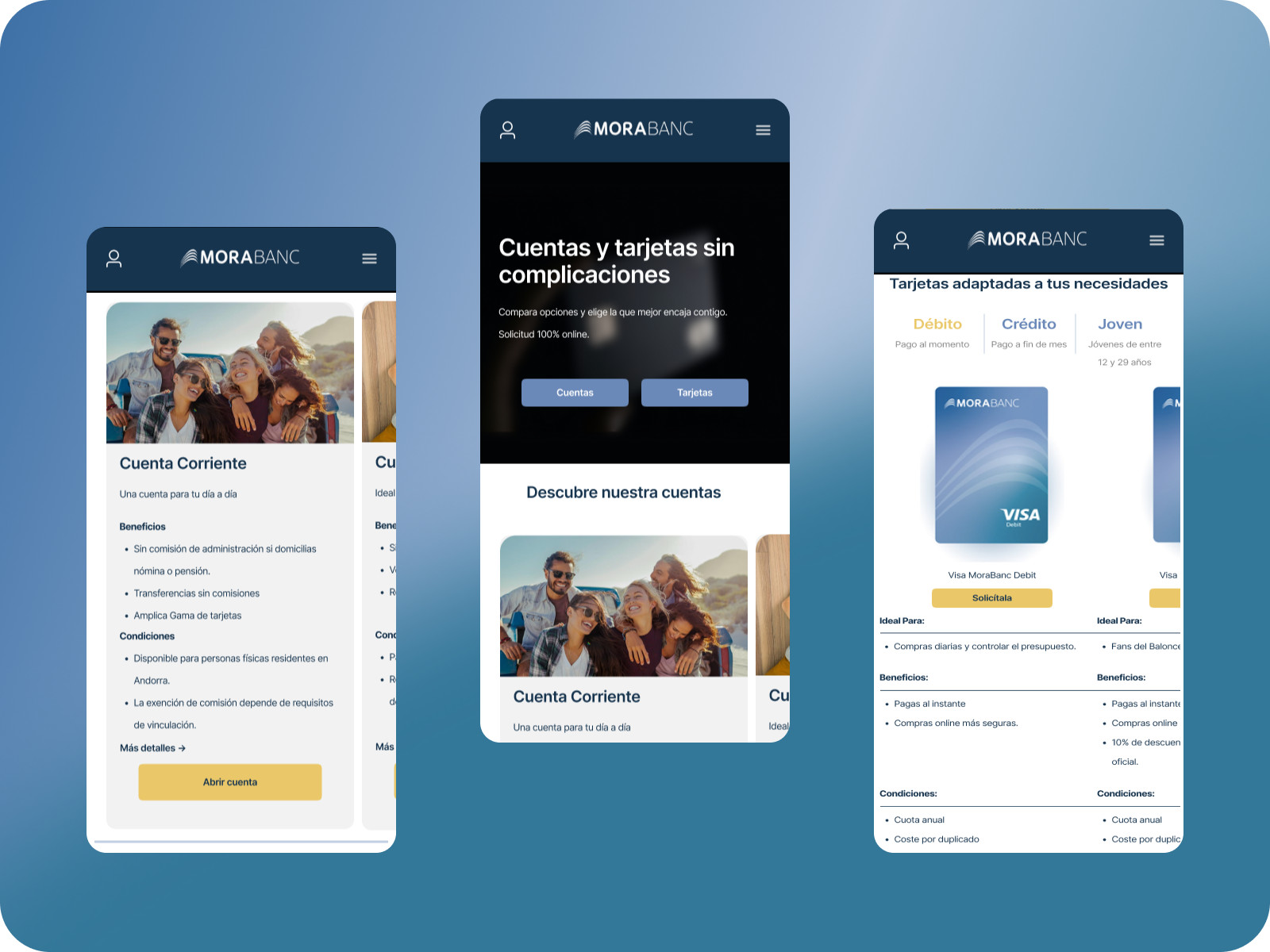

Comparable product cards

Standardized structure across accounts and cards:

Ideal for

Key benefits

1–2 decisive conditions

Primary CTA (“Apply” / “Open account”)

No need to navigate away to compare

Guided card selection

Clear categorization (Debit / Credit / Youth)

Logical defaults to reduce initial choice overload

Filters instead of carousels to keep all options visible

Confidence at the right moment

FAQ and reassurance placed before the final CTA

Common objections resolved without breaking the flow

Consistent CTAs to avoid doubt about the next step

Validation & success criteria

-

Hypotheses

Users understand categories faster

Comparison requires less effort

Users reach “Apply” with fewer doubts

-

Proposed validation

Moderated usability testing with comparison tasks

Time-to-decision measurement

Confidence rating before starting application

-

Success indicators

Faster time to first meaningful action

Reduced back-and-forth between products

Higher confidence reported before conversion

Outcome

This case demonstrates how research-led strategy and structured decision design can reduce complexity in high-trust environments.

Rather than adding features or content, the solution focuses on:

Making differences explicit

Reducing unnecessary choice

Guiding users toward confident action

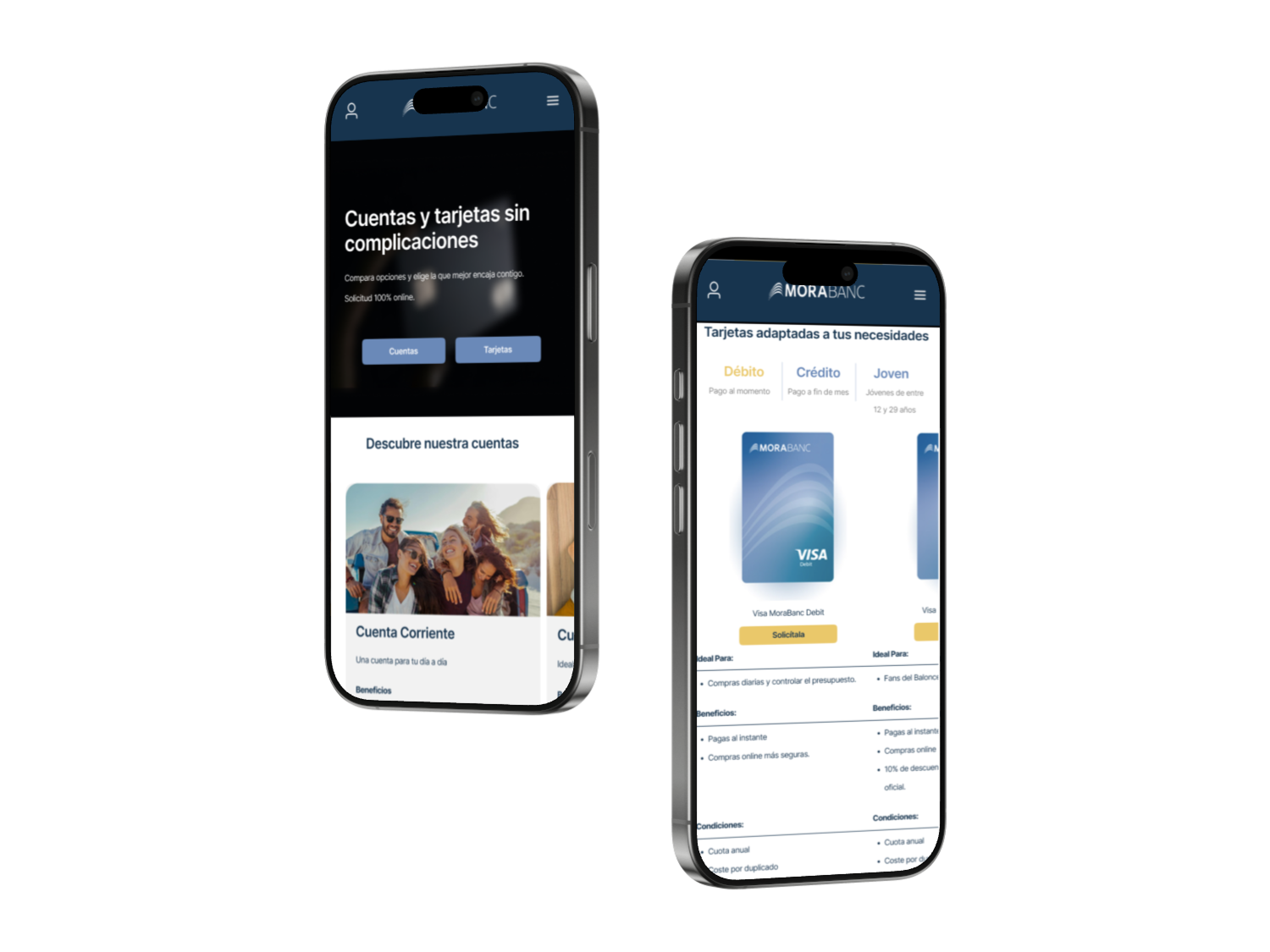

Prototype

The prototype was created to validate structure, hierarchy, and decision flow — not to define final visual design.

It focuses on: Understanding the offer at a glance, Comparing options without memorization, Reaching a clear next step with confidence